In a groundbreaking move, the Federal Ministry of Industry, Trade, and Investment (FMITI) has initiated three funds totaling N200 billion to bolster businesses nationwide, offering favorable nine percent interest rates through the Bank of Industry (BOI).

Simultaneously, the Corporate Affairs Commission (CAC) joined forces with Moniepoint Micro Finance Bank to register an unprecedented two million Micro, Small, and Medium Enterprises (MSMEs), ushering them into formal operations in Nigeria.

The established funds comprise the Presidential Conditional Grant Scheme (PCGS), the FGN MSME Intervention Fund, and the FGN Manufacturing Sector Fund, administered by BOI, reaffirming its dedication to MSME development, echoing President Bola Tinubu’s Renewed Hope Agenda.

The PCGS, a N50 billion grant, targets Nano Business owners, with a commitment to support a minimum of 1,000 beneficiaries per Local Government Area (LGA) across the nation, particularly focusing on women and youths. Beneficiaries are not required to repay the grant but must meet specific eligibility criteria.

Additionally, the FGN MSME Intervention Fund, valued at N75 billion, aims to alleviate the challenges faced by MSMEs, offering a maximum of N1 million per beneficiary at a nine percent interest rate.

The third component, the N75 billion FGN Manufacturing Sector Fund, extends support to eligible manufacturing companies, providing up to N1 billion per beneficiary at a similar interest rate.

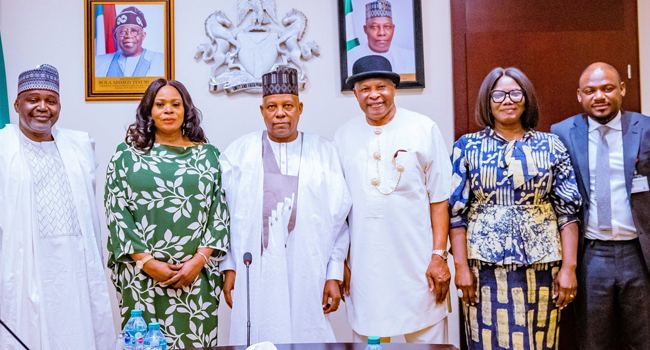

In parallel, the CAC, in collaboration with Moniepoint MFB, orchestrated the registration of a remarkable two million MSMEs, marking a significant stride towards formalizing their operations. Minister of Industry, Trade and Investment, Dr. Doris Uzoka-Anite, hailed the initiative as monumental, aligning with President Tinubu’s vision of creating 50 million jobs.

Acknowledging the milestone, Registrar-General/Chief Executive of CAC, Hussaini Ishaq Magaji, highlighted the commission’s goal of formalizing 20 million small businesses this year, envisioning a substantial boost to job creation and revenue generation.

Managing Director of Moniepoint MFB, Mr. Babatunde Olofin, lauded the initiative, emphasizing its potential to foster economic growth and empowerment for MSMEs.