In celebration of its second-year anniversary, MoMo Payment Service Bank (PSB) has launched a series of month-long activities, including a pivotal Stakeholder Conference in Lagos. The event gathered industry leaders, policymakers, and other stakeholders to discuss critical topics in the financial sector under the theme, ‘Empowering SMEs through Digital Financial Solutions’.

This initiative underscores MoMo PSB’s commitment to enhancing financial inclusion, which is vital for economic growth and stability in Nigeria. Financial inclusion enables unbanked and underbanked populations to access essential financial services, driving economic development and poverty reduction.

According to the Nigerian Small and Medium Enterprises Development Agency (SMEDAN), SMEs contribute over 50% of industrial employment and approximately 48% to Nigeria’s GDP. This sector is instrumental in job creation, economic diversification, local development, innovation, entrepreneurship, and poverty eradication.

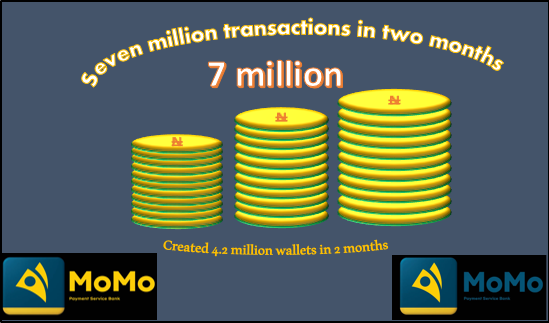

In its two years of operation, MoMo PSB has aligned with the Central Bank of Nigeria’s (CBN) financial inclusion strategies. By leveraging innovative digital financial solutions, MoMo PSB has significantly expanded financial services, targeting Nigeria’s cash-based informal economy and integrating more individuals and businesses into the formal financial system. Financial inclusion in Nigeria has grown from 68% in 2020 to 74% in December 2023, driven by fintech innovations and digital assets, according to data from Enhancing Financial Innovation and Access (EFInA).

Speaking at the conference, Eli Hini, CEO of MoMo PSB, highlighted the challenges SMEs face in attracting interest and investment. “Strong organization is key. When your business is structured and accessible, it becomes attractive to potential investors and partners, opening doors to additional solutions that can drive your business further,” Hini stated.

Hini emphasized MoMo PSB’s role in transforming SME operations by providing a platform that offers easy online payments, international remittance options, and the ability to accept payments from various sources. “These solutions eliminate the need for cash transactions, saving time, reducing risk, and offering clear records for better financial management. By simplifying business processes and offering access to new opportunities, we believe we are empowering SMEs for future growth,” he added.

MoMo PSB’s ongoing efforts to enhance financial inclusion are a critical component of Nigeria’s economic growth and stability, providing SMEs with the tools they need to thrive in an increasingly digital economy.