Nigeria has recently invested Sh1.01 billion ($9.4 million) capital in Nairobi-headquartered pan-African housing development financier, Shelter Afrique, making it the second largest shareholder in the organisation after Kenya.

The West African nation’s stake rose to 14.77 percent on Monday August 7, second behind Kenya’s 14.87 percent and ahead of the AfDB at 14.28 percent, as it moved towards fulfilling a commitment to inject Sh3.16 billion ($29.3 million) in the firm.

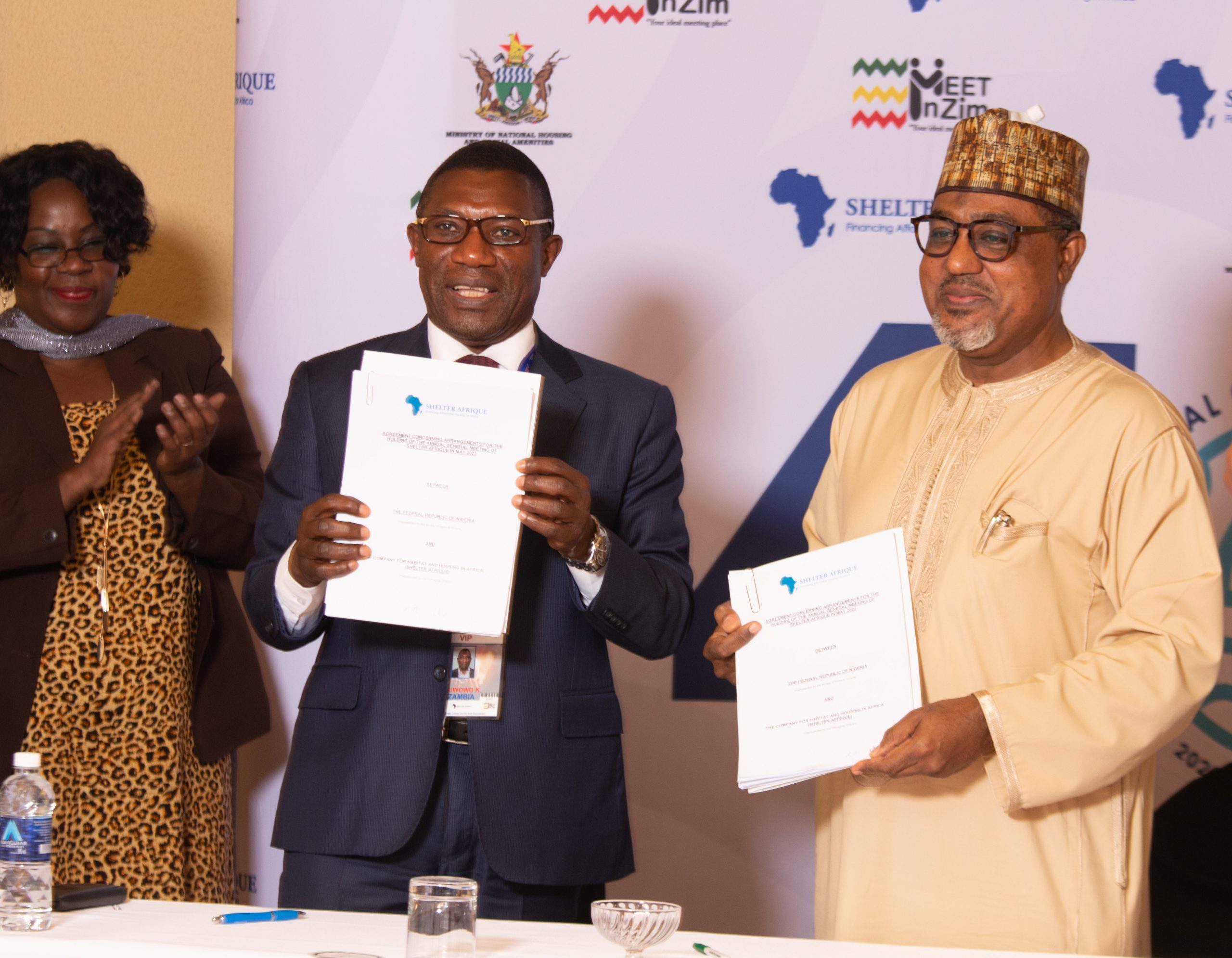

According to Shelter Afrique managing director Andrew Chimphondah, the company has also received a further Sh713 million in additional capital from Rwanda, Uganda, Lesotho, Mali, Namibia, Togo, Zimbabwe and Swaziland.

Shelter Afrique offers a host of unique housing finance products and services, as well as practical advice and technical assistance to a wide range of industry stakeholders. As at December 2019, Nigeria held a 7.4 percent stake in Shelter Afrique, which is jointly owned by 44 African governments, AfDB and African Re-Insurance Corporation.

Shelter Afrique posted a Sh59 million loss for the year ended December, from Sh940.8 million loss reported in 2018. This led to shareholders supporting a recapitalisation of the institution as demonstrated by Nigeria’s significant capital injection and contributions from shareholder countries

“This is a strong show of confidence in Shelter Afrique by member countries that the institution is now better governed and has significantly improved its financial performance,” said Chimphondah.

Prior to the investment, Nigeria increased its stake in AfDB last month from 13 percent to 16.8 percent, ahead of non-regional members Germany (7.4 percent) and the United States (5.5 percent). The capital injection by Nigeria are steps made by the nation towards gaining a larger stake in pan African financial bodies.

Source: Ventures Africa