Nigeria has taken another major step in deepening its capacity for sustainability reporting as stakeholders from the country’s integrated reporting committee and its financial reporting regulator participated in specialised carbon accounting and disclosure training in London. The sessions were organised to equip institutions with the technical knowledge required to implement the IFRS S1 and S2 Sustainability Disclosure Standards, which Nigeria adopted ahead of all other African countries.

The training, coordinated by a UK-based consultancy firm, focused on building local expertise in emissions measurement and sustainability-related financial reporting. The Nigerian delegation also held a strategic visit to an innovation laboratory in London, where they engaged in collaborative discussions on emissions accounting and climate risk assessment, two key components of the IFRS sustainability framework now being rolled out in Nigeria.

The sessions explored global greenhouse gases contributing to climate change and examined how organisations applying the new disclosure standards can reduce their carbon footprint. Participants reviewed Scope 1, Scope 2 and Scope 3 emissions, paying particular attention to Scope 3’s investment-related category, which is especially relevant for financial institutions in Nigeria.

The training also included practical exercises using spreadsheets to calculate emissions inventories, alongside discussions on identifying material sustainability risks and opportunities. These exercises involved estimating probabilities, assessing financial impacts and developing climate scenario models that quantify short, medium and long-term effects on organisational performance.

Another key component of the programme covered how companies can identify sustainability risks and opportunities even when no specific IFRS sustainability standard exists. The training also examined how the IFRS standards interact with other major global disclosure frameworks, including European sustainability reporting rules, the Global Reporting Initiative and emerging nature-related financial disclosures. This convergence is expected to support easier reporting for Nigerian organisations operating across international value chains.

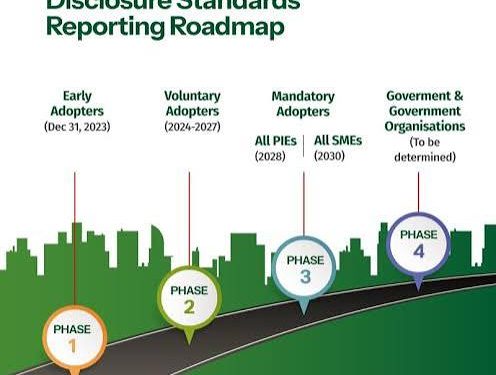

According to the organisers, the London training was designed to strengthen institutional capacity at Nigeria’s reporting institutions, with the knowledge gained expected to guide both voluntary and mandatory adopters of IFRS S1 and S2. Insights from the sessions have already informed plans to revise Nigeria’s implementation roadmap and issue additional guidance to help preparers navigate the new reporting environment more effectively.

Nigeria remains the first African country to adopt the IFRS S1 and S2 standards and the only one to have produced early adopters, giving it a unique head start on the continent. More than two thousand professionals across key sectors such as banking, insurance, oil and gas, telecommunications, consumer goods and agriculture have already received sustainability training under the country’s integrated reporting partnership.

This growing pool of trained practitioners is expected to support businesses, including MSMEs, as they align with global sustainability reporting trends that increasingly influence investment decisions, supply chain participation and regulatory compliance across African markets.