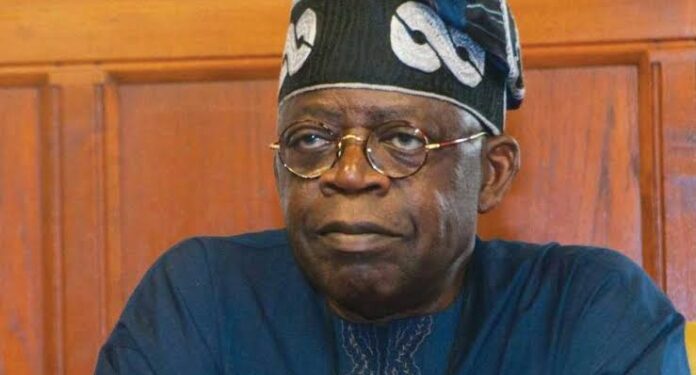

In their first 17 months in office, President Bola Tinubu and Vice President Kashim Shettima undertook 41 trips across 23 countries, spending a total of 180 days abroad—approximately six months—on various foreign engagements. An analysis reveals that President Tinubu made 29 trips to 16 countries, spending over 124 days outside Nigeria, while Vice President Shettima completed 12 trips to 10 countries, accumulating 56 days abroad.

President Tinubu’s travel itinerary includes visits to diverse nations: Malabo in Equatorial Guinea, London in the UK (four times), Bissau in Guinea-Bissau (twice), Nairobi in Kenya, Porto-Novo in Benin Republic, The Hague in the Netherlands, Pretoria in South Africa, Accra in Ghana, New Delhi in India, Abu Dhabi and Dubai in the UAE, New York in the USA, Riyadh in Saudi Arabia (twice), Berlin in Germany, Addis Ababa in Ethiopia, Dakar in Senegal, and Doha in Qatar.

Vice President Shettima’s travels have taken him to Rome in Italy, St. Petersburg in Russia, Johannesburg in South Africa, Havana in Cuba, Beijing in China, Iowa and New York in the USA, Davos in Switzerland, Yamoussoukro in Ivory Coast (twice), Nairobi in Kenya, and Stockholm in Sweden. He has logged over 93 flight hours in his diplomatic missions.

Despite these intensive diplomatic efforts, data from the National Bureau of Statistics indicates that Nigeria recorded no foreign capital inflow from 11 of the visited countries during the first half of 2024. Tinubu’s trips to Equatorial Guinea, Guinea-Bissau, Benin Republic, Ethiopia, Ghana, Senegal, and Qatar did not result in any investments. Similarly, Shettima’s outreach to Russia, Cuba, and Ivory Coast also failed to attract capital inflows. Even Kenya, a shared destination for both leaders, yielded no foreign investment during this period, illustrating the difficulties Nigeria faces in converting diplomatic engagements into tangible economic benefits.

Conversely, 12 other countries provided a total of $5.06 billion in investments in the same timeframe, representing a significant 201.7% increase from the $1.68 billion recorded in the first half of 2023. Countries that President Tinubu exclusively visited accounted for the bulk of Nigeria’s investment inflows, contributing $4.16 billion. Key contributors included the United Kingdom, Netherlands, South Africa, Saudi Arabia, UAE, India, Germany, Ethiopia, Benin Republic, Guinea-Bissau, Ghana, Senegal, and Qatar.

Among these nations, the UK had the most substantial impact, with investments soaring by 263.5% from $805.13 million in the first half of 2023 to $2.93 billion in the first half of 2024. Shettima’s visits to countries like Russia, China, Italy, Cuba, Ivory Coast, Sweden, and Switzerland generated a modest $56.09 million in total investment. Notably, China’s contribution rose to $35.64 million in the first half of 2024, compared to just $0.25 million the previous year.

Three countries—Kenya, South Africa, and the United States—were visited by both leaders and collectively yielded $1.25 billion in capital inflows. South Africa’s contribution surged by 267.5%, climbing from $228.09 million in the first half of 2023 to $838.32 million in 2024, while Kenya recorded no inflows. However, investments from the United States fell by 53.5%, decreasing from $367.28 million to $170.86 million. The Netherlands emerged as another significant contributor, with inflows jumping 901.7%, from $65.88 million to $659.91 million.

Further increases were observed in Saudi Arabia, where investments rose from $0.03 million to $147.07 million, and in Germany, with inflows climbing from $0.81 million to $19.12 million. The UAE also maintained a steady inflow, with investments slightly increasing from $209.41 million to $245.19 million.

Recent reports using GovSpend, a civic tech platform tracking government spending, revealed that the State House spent N44.88 million on visas for officials, including aides to President Tinubu and Vice President Shettima, in March 2024. The data outlined four separate transactions related to securing long-term visas for international engagements, particularly for the UK and France.On March 7, 2024, the State House processed payments amounting to N13.01 million for a two-year UK multiple-entry visa and a five-year multiple-entry visa to France for Vice President Shettima. Additional transactions on March 27, 2024, indicated that N31.87 million was spent on visas for aides and staff members, with N25.8 million allocated for long-term UK visas for several aides to President Tinubu.

Auwal Rafsanjani, Executive Director of the Abuja-based Civil Society Legislative Advocacy Centre, emphasized the importance of ensuring that foreign trips yield significant economic returns for Nigeria. “It is essential that public officials understand that the country does not have the resources to embark on travels without significant economic value to the nation,” he stated.

Peter Obi, the Labour Party presidential candidate during the 2023 elections, criticized the timing of the leaders’ foreign trips amid pressing domestic challenges, expressing concern that the absence of both the President and Vice President from the country could be detrimental when citizens need leadership the most.

Additionally, reports indicate that Foreign Direct Investment (FDI) in Nigeria fell to $29.83 million in the second quarter of 2024, the lowest level recorded since 2013. This represents a 65.33% decrease compared to the $86.03 million recorded in the same period last year and a 74.97% decline from the $119.18 million reported in the previous quarter.

While President Bola Tinubu has asserted that his administration has successfully attracted $30 billion in FDI commitments, the decrease in actual foreign investment underscores the significant challenges Nigeria faces in attracting long-term investment amidst a tough global economic climate and persistent domestic issues. It was noted that FDI constituted only about 1.15% of the total capital importation of $2.60 billion in the quarter under review.

In comparison, foreign currency loans, including portfolio investments and direct loans, contributed $2.55 billion, representing a staggering 98.08% of total inflows. This preference for loans over equity investments reveals investor caution, as foreign investors tend to favor safer financial instruments rather than committing to long-term projects.

The reliance on foreign currency loans illustrates a broader trend where short-term investments and debt instruments dominate Nigeria’s capital importation landscape. While these inflows can provide immediate liquidity to the economy, they do not offer the same level of stability or growth potential as direct investments into physical assets or infrastructure.

In summary, Nigeria’s foreign engagements led to substantial travels and modest investment gains but raised critical concerns about their effectiveness in generating tangible economic benefits for the country. As challenges persist, the focus on ensuring that diplomatic missions yield significant economic returns is more crucial than ever for the nation’s growth and development.