Salad Africa, a rising fintech company specializing in embedded lending infrastructure, has announced a strategic partnership with Glovo, a leading multi-category delivery app, to launch a groundbreaking SME financing initiative for Nigerian businesses on the Glovo platform.

This first-of-its-kind program aims to provide Glovo partners, particularly small and medium-sized enterprises (SMEs), with fast, collateral-free access to working capital. Through Salad Africa’s lending infrastructure, eligible Glovo merchants can secure loans ranging from ₦50,000 to over ₦100 million, offering more flexible terms than traditional financial institutions.

Data-Driven Financing, Built Into the Glovo Ecosystem

Unlike standard loan systems, the program leverages real-time sales data from the Glovo app to assess eligibility and creditworthiness. To qualify, merchants must have been active on the Glovo platform for at least three months and meet specified performance and operational criteria. Once approved, funds are disbursed directly, and repayments are made as a percentage of future sales, seamlessly processed through the Glovo platform.

This data-driven and collateral-free approach ensures faster, fairer, and more accessible lending—empowering SMEs to scale operations, launch new products, and grow revenue, all within the Glovo ecosystem.

A Major Boost for SMEs in the Digital Economy

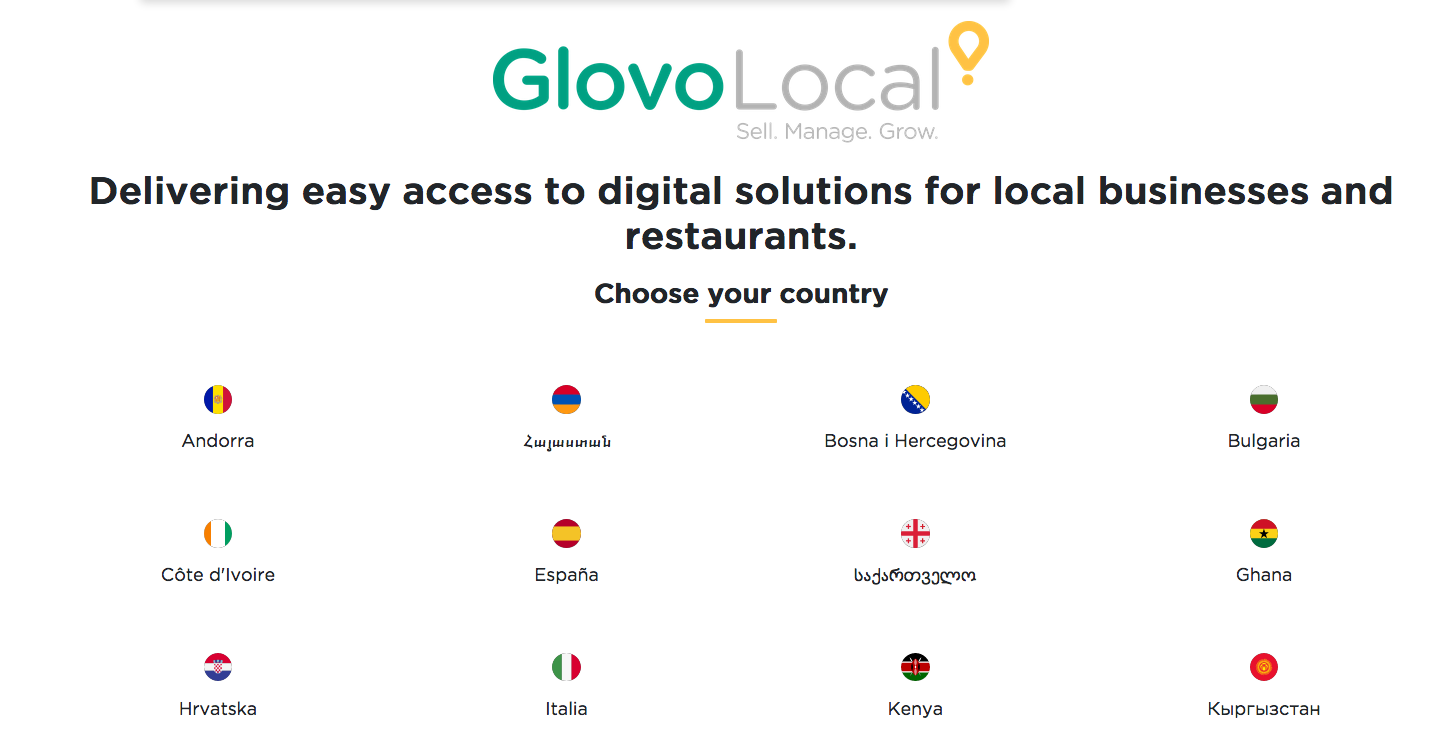

The initiative forms part of Glovo Local, a global program that supports SMEs in thriving within the digital economy. SMEs account for 90% of shops and restaurants on the Glovo app across 23 countries, and benefit from tools including marketing support, order management, training, and financial resources.

As the first platform in Europe, Africa, and Central Asia offering this form of embedded SME financing, Glovo is reinforcing its commitment to inclusive, sustainable growth.

Leadership Comments

Kolawole Adeniyi, Head of Commercial at Glovo Nigeria, said:

“At Glovo, we’re constantly looking for ways to empower our partners and support their growth journeys. Through this initiative, we’re providing access to much-needed working capital directly within our ecosystem, making it easier and faster for our partners to scale. This partnership with Salad Africa is a game-changer—it ensures our merchants can unlock new opportunities without traditional barriers.”

Chikodi Ukaiwe, CEO of Salad Africa, added:

“Supporting local businesses is at the heart of everything we do at Salad, so we’re thrilled to partner with Glovo to provide small and medium-sized restaurants with fast, fit-for-purpose financing to meet growing demand and scale their operations. Embedded finance is unlocking new channels of credit that simply weren’t available before, and we’re proud to be making access to capital more seamless and timely for Glovo’s network of restaurants.”

Scaling Impact Through Innovation

This partnership highlights Glovo’s role as a growth partner for local businesses, while Salad Africa continues to transform SME financing across the continent. To date, Salad has unlocked $1.5 million in credit and supported over 1,500 SMEs in scaling sustainably.

Together, Glovo and Salad Africa are removing financial barriers, driving inclusion, and fueling the digital transformation of Nigeria’s local businesses.