Before I throw an unsolicited advice, let us look at what both terms mean.

Liquidity in technical terms, can be as:

- current asset i.e., cash and cash equivalents (e.g., cash, bank balances, prepaid balances, receivables, inventory).

- Your ability to convert assets to cash. Your business is said to be liquid if you are able to use your liquid or near-liquid assets (technically current assets) to meet your short-term obligations as and when due.

As a play on words, profitability is how profitable your business is. Profit is the difference between revenue and expenses when the former is in excess of the latter. If otherwise, then it is a loss.

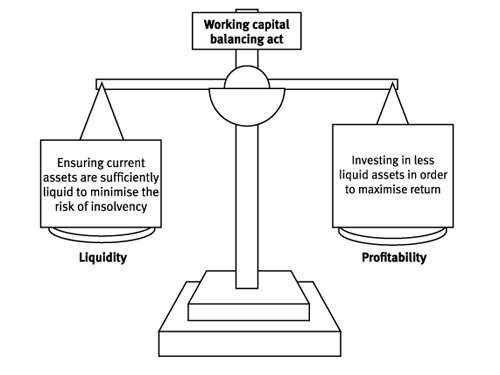

Paradoxically, and as shown in the image, it is possible for a business to be profitable yet illiquid (around quadrant A), and conversely, liquid, but unprofitable (around quadrant D). Other combinations are also likely e.g., unprofitable and illiquid (around quadrant C), or profitable and liquid (around quadrant B).

So, what should be your business goal?

Permit me to use the Water, Garri, Milk, and Groundnut analogy; who is with me?

Even after a good meal, I love to top it up with the above combination. Think about adding ice to the mix; yummy innit?

I have discovered in my drinking Garri journey that my ability to have an optimal mix determines my level of enjoyment. This optimal mix is also dependent on the type of Garri (Ijebu Garri, well done), the type of ice, the type of milk, and the condiment (Kuli Kuli or Groundnut). The goal is to ensure that everything blends accurately for maximum enjoyment. Apologies if you are already salivating, but stress less, you can order from xxx who is a verified Garri seller. When water is too little, consuming Garri becomes difficult. If water is too much, you will not be able to comfortably lift the Garri with your spoon. If the groundnut (or KuliKuli) is too much, they will interfere with the amount of Garri you can take per time. Finding that balance is what separates the chaff from the grain, hence my simple answer using the Garri analogy is to find a balance – between profitability and liquidity. Your business needs both liquidity and profitability to be in the right direction; you should not pursue one at the expense of the other.

The danger of pursuing liquidity without much thought for profitability can lead to excess idle funds which we believe is an element of resource underutilisation. This can be fuelled by a fear opportunity. So, you hear some say that it is better to keep the money in sight than at the bank. Pursuing profitability at the expense of liquidity can forge unwholesome business practices that portray false profit and ruin the business.

How do you know that you are pursuing profitability at the detriment of liquidity and vice versa?

I will my exposition to one scenario each, because of space constraint. A business that pursues profitability at the expense of liquidity will for instance concentrate too much on sales on credit – the keyword is excessive concentration on credit sales. Based on the realization concept, the accounting system will show credit sales as revenue, but bank balances will not feel the impact, hence it is possible to post profit without cash.

Inversely, a business that focuses too much on liquidity at the expense of profit might emphasize on cash sales notwithstanding the potential for higher revenue which can come from planned credit sales. That way, the business will only do business if cash is readily available, making it have cash, but low profit.

A business owner or manager requires data, skills, and insights to balance the profitability-liquidity paradox for optimal performance.

See you next time.