In Africa, where the informal sector is a vital component of the economy, data-driven decision-making is increasingly recognized as a critical factor for the growth and

sustainability of small and medium-sized enterprises (SMEs). Nigeria, South Africa, Kenya, and Egypt are four of the most important economies on the African continent, each playing a pivotal role in shaping the region’s economic landscape. These nations are among Africa’s largest and most diversified economies and serve as regional hubs for entrepreneurship, innovation, and investment.

Nigeria, with the continent’s largest population and economy, is a powerhouse driven by its oil industry and growing tech sector. South Africa, the most industrialized nation in Africa, boasts a robust infrastructure and a diverse economy spanning mining, manufacturing, and services. Kenya, often dubbed the “Silicon Savannah,” is recognized for its leadership in mobile money and technology innovation, making it a critical player in East Africa.

Meanwhile, Egypt, with its strategic location and historical significance, is a key economic gateway between Africa, the Middle East, and Europe, underpinned by a diverse economy that includes tourism, manufacturing, and agriculture.

These four countries are essential not just for their economic size but also for their influence on regional stability, trade, and innovation. Their economic policies and growth trajectories significantly impact the broader African economy. In this context, understanding the relationship between data, inequality, and SMEs—particularly in the informal sector—is crucial for unlocking their full potential and addressing the socioeconomic challenges that

persist across the continent.

Across Nigeria, South Africa, Kenya, and Egypt—the ‘’Big 4’’ as they are often referred to—the importance of data in product development, market expansion, and strategic planning cannot be overstated. Yet, the lack of accessible and reliable data has long hindered the potential of SMEs, exacerbating inequalities and stifling economic progress.

However, recent developments suggest that this situation is gradually improving, with promising implications for the future.

The Crucial Role of Data in SME Decision-Making

Data serves as the lifeblood of informed decision-making for startups and SMEs. Entrepreneurs across the continent rely on data to understand market needs, consumer

behavior, and competitive landscapes. This information guides product development, marketing strategies, and operational efficiencies. For instance, understanding consumer preferences in Lagos, Johannesburg, Nairobi, or Cairo can enable businesses to tailor their offerings, thus increasing their chances of success.

However, in many African countries, the informal sector, which employs the majority of the workforce, operates largely outside the formal data collection systems. SMEs in this sector often lack access to reliable data, making it difficult for them to make informed decisions. This data gap creates a vicious cycle: without data, businesses cannot optimize their operations or scale effectively, leading to missed opportunities and stagnation. Egypt, for instance, hosts the largest and most productive cotton and textile clusters on the African continent, as the entire production process—from the cultivation of raw materials (mainly cotton) to the manufacture of yarns, fabrics, filament yarns, and fibers, and the production of ready-made garments—takes place in Egypt. However, the lack of access to reliable market data has been a major barrier to growth for SMEs in this industry.

Small textile manufacturers often lack information about global market trends, consumer preferences, and supply chain dynamics. This lack of data has led to missed opportunities in export markets, where there is demand for specific types of fabrics and designs that Egyptian SMEs could potentially supply.

In Cairo, the nation’s capital and erstwhile textile hub, small-scale garment producers are unable to compete effectively in international markets due to their lack of insight into global fashion trends and customer preferences. This information gap limits their ability to innovate or adjust their products to meet market needs in comparison to their European counterparts across the Mediterranean, thereby stunting their growth and limiting their ability to expand beyond local markets.

The Impact of Data Deficiency on SME Growth and Inequality

The absence of verifiable data has significant implications for inequality, particularly in countries where the informal sector dominates the economy. In Nigeria, for instance, the informal sector accounts for over 60% of the workforce, yet many of these businesses remain trapped in subsistence operations due to limited access to information. Similarly, in South Africa, where the informal sector provides a critical safety net for millions, the absence of data-driven insights prevents SMEs from accessing markets, capital, and growth opportunities

In Kenya and Egypt, the story is much the same. The informal sector is a major employer, yet businesses often lack the data needed to understand market dynamics or consumer preferences. This situation perpetuates inequality, as those without access to data are unable to compete with larger, more established firms that can afford sophisticated market research. The result is a widening gap between the formal and informal economies, with the

latter remaining marginalized.

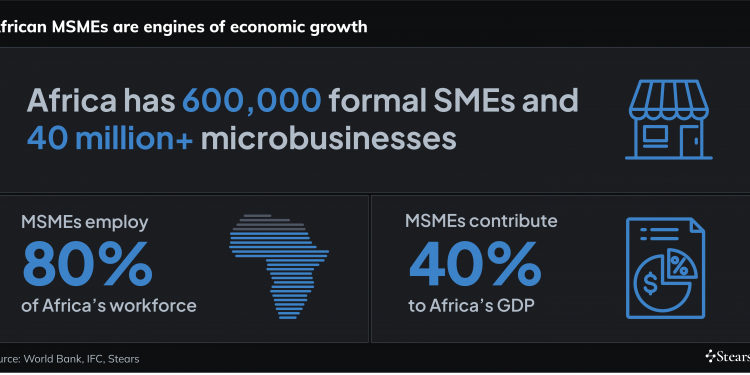

The concentration of data among a few powerful entities—primarily governments and large private corporations—directly contributes to the widening of inequality, particularly for SMEs in the informal sector. In Africa’s ‘’Big 4’’, the informal sector is a critical engine of economic activity, employing millions and sustaining livelihoods. However, the lack of access to vital data severely limits the ability of these SMEs to compete, grow, and innovate.

When data is concentrated in the hands of a few, it creates a significant barrier for SMEs in the informal sector. These small businesses often lack the resources to collect, analyze, and apply data in ways that larger companies can. As a result, they are unable to make informed decisions about market trends, consumer preferences, and operational efficiencies. This puts them at a distinct disadvantage, as they are less equipped to anticipate changes in the market, adapt their products and services, or identify new opportunities.

The widening of inequality manifests as larger firms—armed with data-driven insights—continue to grow, capture market share, and generate higher profits, while SMEs in the informal sector remain stagnant or even decline. This dynamic reinforces existing economic disparities, as wealth and opportunity become increasingly concentrated among those who control and can effectively use data.

How Access to Data Can Reduce Inequality

Improving access to data for SMEs, particularly those in the informal sector, could play a transformative role in reducing inequality. With reliable data, small businesses can better understand their markets, optimize their operations, and identify new growth opportunities.

This, in turn, can lead to increased income, job creation, and economic mobility, particularly for those at the lower end of the economic spectrum. Entrepreneurs who have access to information about consumer trendds and preferences are better equipped to develop products that meet market needs, thereby increasing their

competitiveness. In South Africa, efforts to integrate informal businesses into the formal economy through data-driven strategies, exemplified by the National Integrated ICT Policy (2016) are helping to level the playing field, allowing SMEs to tap into new markets and expand their operations.

In Kenya, the rise of mobile money platforms like M-Pesa has not only revolutionized financial inclusion but also provided a wealth of data that can be used to inform business decisions. By analyzing transaction data, SMEs across the country, from Nairobi to Mombasa, gain insights into consumer behavior and tailor their products accordingly

In Nigeria, the emergence of tech hubs and incubators is fostering a data-driven culture among startups. This growth has been fueled by the increasing demand for digital solutions, a youthful population, and supportive government policies aimed at fostering entrepreneurship and technology-driven growth. These hubs provide not only mentorship and funding but also access to market research and analytics tools, empowering entrepreneurs to make informed decisions. These hubs have contributed to the growth of Nigeria’s tech ecosystem, leading to the emergence of successful startups in fintech, e-commerce, health tech, and agritech and the eventual emergence of four out of Africa’s seven unicorns.

The success of Nigeria’s venture capital (VC) unicorns, such as Flutterwave, Paystack, and Andela, is fundamentally tied to their strategic use of verifiable data. This data-driven approach has been essential in various facets of their growth, from securing investment to scaling operations, optimizing customer experience, and navigating regulatory environments.

Verifiable data allowed these companies to optimize their operations by identifying inefficiencies and areas for improvement. For example, Andela used data to match software developers with global companies, ensuring that the right talent was placed in roles where they could be most effective. This data-driven matching process was critical in scaling the business across multiple countries.