The Year 2020 started with a big bang and the euphoria associated with the start of a new century. So many goals and expectations were carefully crafted waiting to be executed. Several businesses and individuals planned for great showing and events in the year. The Year started on a pleasant note and the journey began.

No sooner than the year started, everything came crashing as the entire world stood still in the wake of the Coronavirus which started from China.

The events of the last few months have been undoubtedly disruptive and devastating for many business owners and entrepreneurs.

The COVID pandemic has dealt a big blow on many sectors and businesses especially the non-essential, travels, hospitality, and personal care just to mention a few. The price of oil has dropped, revenue has tanked. These have led to businesses cutting down staff strength and most supply chains have been disrupted. Alas!!! All financial plans have almost gone for a toss.

Some businesses and industries have been adversely impacted by varying degrees. Businesses have been categorized into 2 major areas: – non-essential and essential. Essentials are the items we need for survival such as food, logistics, and healthcare, medical supplies. Non-essentials include hospitality, entertainment, travel, events, luxury, etc. The non-essentials have been adversely affected by social distancing and restrictions, border closure, etc.

Revenue of airlines has dropped significantly and some have filed for bankruptcy.

Some businesses have shut down and many are working from home. Some have also scaled up their online presence to sell. The logistics value chain has increased to support the delivery of goods and services.

Business owners and entrepreneurs are overwhelmed and in survival mode. Some have resorted to their reserves to make ends meet.

In all these, your mindset and mental health are very important & critical. It is when you are alive and in good health that you can think of managing a business in the future. So you need to be mentally okay.

This is the time to take another look at your business models and see what can be done. The ability to adapt to the changes and requirements will help to navigate and get over this situation.

In all these situations, I want to encourage you not to give up the fight. You need to find the strength within, build resilience, and receive instruction for the next level.

This is the defining moment in our lives and I understand it’s not been very easy. No one envisaged or prepared for this.

It’s certainly a wakeup call for everyone to re-evaluate and re-strategize. We have to come up with various survival tactics as this has impacted the entire world.

See this as an opportunity to reflect, rethink, and reemerge- evaluate what works for you. Don’t follow the multitude it is okay to reset and think. Be comfortable and don’t put yourself under unnecessary pressure. It is your life. You do not owe anybody any apology.

Either you change or change is changing you. Learn to use the change to your advantage. Turn the obstacles to stepping stones. It is not the time to beat yourself up or feel depressed. You did not cause the pandemic. Focus on what you can control.

Start asking the right questions. How am I going to survive? Is your business essential or nonessential?

- Planning to Re-imagine, re-engineer your products or service offerings:See your business with new eyes. Business is war. So we need to find new ways of adapting this period.

- What else can you do? Start engaging with your customers. Show concern. Empathize with them, ask them how you can help them. It forces rest and rethinking.

- Identify new revenue streams, diversify what are the things people need now. Be fast in your thinking adapt & find new ways.

- On the international scene. Carmakers have turned to produce ventilators example Mercedes, ford, designer brands now making sanitizers and face masks. Local brands like Ruff & Tumble was not left out of the pivot activities.

- Many other fashion designers are into facemasks and some have moved to the essentials like bread making. No matter what happens. Man must eat.

- Even in the pandemic, some companies providing online connectivity like Zoom, Webinar Jam, Microsoft team, etc increased their market size and worth.

- Online streaming increased- Netflix, Youtube, Tiktok, etc became cash cows.

- Knowledge has become the new gold. Online courses have increased. Schools are rethinking their model as well

- Gyms are now offering online workout sessions, online dance classes.

- Many hotels and food outlets resorted to online ordering and home deliveries through logistics companies.

- So it is time to digitize your products and services and ensure you are present online. Ensure you are visible on different social media platforms. Several professionals have resorted to teaching their skills online- digital marketing activities have increased.

- Ignite the Power of Collaboration & association: See how you can cross-sell and bundle your products- For example- Food & delivery services.

- Does my business have any knowledge it can digitize for a fee? Teaching what you do.

- Sort out your finances – Building solid base for your business:

Several businesses were caught unawares from a cash flow perspective and because there was not a solid structure. The cash reserve was not sufficient to immediately cushion the effect.

Financial management entails planning, organizing, controlling, and monitoring the financial resources of your business to achieve the objectives you have set.

It can be compared to the maintenance of your cars. If you don’t put in quality fuel and oil and give it regular service, the functioning of the car will suffer and not run efficiently. If neglected, the vehicle will eventually break down and fail to reach its intended destination.

Financial Structure.

- Some businesses do not have financial structures. Records were not kept; hence they could not immediately figure out what to do and how long their cash was going to last. This is one area that requires urgent attention to put the accounting system in place.

- As a business owner, you need to know your numbers. How many customers do you have? how much is each customer generating? With proper bookkeeping and accounting, you will be able to generate your financial statement to determine whether you are profitable or not?

- You will be able to ascertain how much cash you are generating in the business. Note that while profit shows whether the business is worth doing, cash keeps the business in operation. So you need to track your cash flow effectively.

Cash Flow Management:

- Start by ensuring you invoice appropriately because that is what will generate your cash, sales without cash is useless.

- The way you track your sales and operating expenses will ensure the liquidity of your business.

- Make sure your collection policy is tighter than your payment policy. For example, you can give 60 days’ credit when you have to pay salaries, utilities, running costs, supplies in 30 days. You will always have issues with your cash. Drive improvement in debt collections.

- Ensure your net cash (the difference between your cash inflow and your cash outflow) is positive. If you don’t keep records, this will be difficult to achieve.

- Conserve your cash by focusing only on essentials. if possible build emergency funds. Proactively communicate and manage the relevant stakeholders. Take actions to defend/protect and improve the current position.

- Do you have any loans? do you need to defer the payments? Can you keep your staff? Cut off any unnecessary costs.

- How long can the cash available take you? What are the immediate and long term cash requirements? Prepare scenarios and think of how you will bridge the gap.

- Face reality and calculate how much is required to run your business.

Optimize your expenses

- Evaluate your costs and cut down on non-essential costs. To help you do this segregate your costs into revenue-generating and non-revenue generating costs. Prioritize only essential cash-generating key expenses, stager payments to non-essential vendors, and cancel any frivolous expenses.

- Use accurate data of cost to reprice your products and services as much as possible. Implement cash conservation measures and instill consciousness in the organization.

- Check if there are any force majeure clauses to be explored.

Funding & Interventions:

- Identify and proactively engage all relevant stakeholders: – shareholders, investors, customers, trade vendors, regulatory authorities.

- Explore government grants and waivers for your organization: -Make use of all the available grants and intervention funds e.g the N50b CBN fund.

- Evaluate funding opportunities offered by various government agencies: – Bank of Industry (BOI), NIRSAL Micro Finance Bank, Small & Medium Enterprises Development Agency of Nigeria (SMEDAN) and the various loan moratorium in place, Development Bank of Nigeria (DBN), etc.

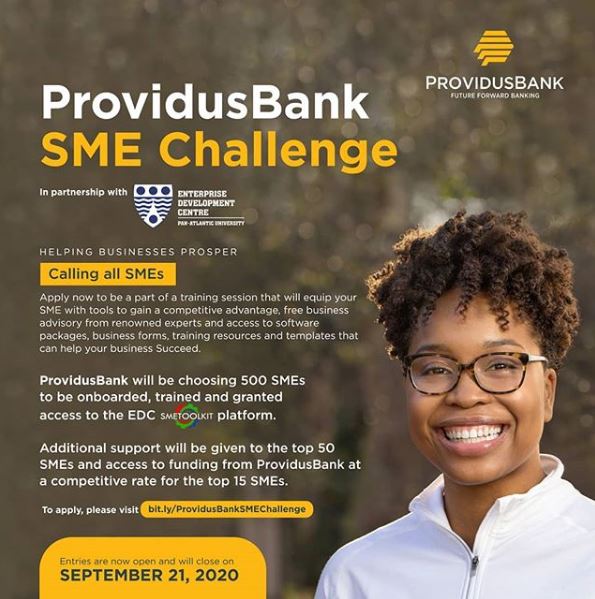

- Meet with your banks to see the various schemes they have for entrepreneurs

- Explore credit lines with financial Institutions and drawn down in full immediately. Renegotiate existing repayment terms.

- Engage and seek waivers from the tax authorities to renegotiate your payment plan that suits your cash flow.

As you weather the storm of this pandemic, choose to deliberately and intentionally stay positive. You are the secret sauce to keep everything working. Therefore, guard your conscious and subconscious mind.

Every challenge brings with it immense value. Therefore, hope for the best and prepare for the worst.

The entrepreneur journey doesn’t stop and it doesn’t pause. So your business needs to remain nimble and be ready to adapt quickly to the new possibilities in the evolving world of new normal instead of waiting for the return of normalcy.

Oluwatoyin Aralepo is a first-class accounting graduate, a fellow of the Institute of Chartered Accountant of Nigeria (ICAN), fellow of the Institute of Information Management of Africa and an Alumni of the London School of Business and Finance (LSBF), with over 15 years’ wealth of experience across Banking, Telecoms and Fintech.

She was the Head of Budget in UBA, Commercial Controller and Financial Controller at Airtel and CFO of Cellulant Nigeria.She recently founded Africa Finance & Strategy Hub to support businesses especially SMEs have access to professional financial management skills, and tools that will assist them to understand, manage and scale their businesses. She wants to help businesses build financial structures to maximize their cash and profit.

IG @toyinaralepo, @africafinancestrategyhub, FB :toyinaralepo, LinkedIn @oluwatoyin Aralepo, Website http://africafinancestrategyhub.com