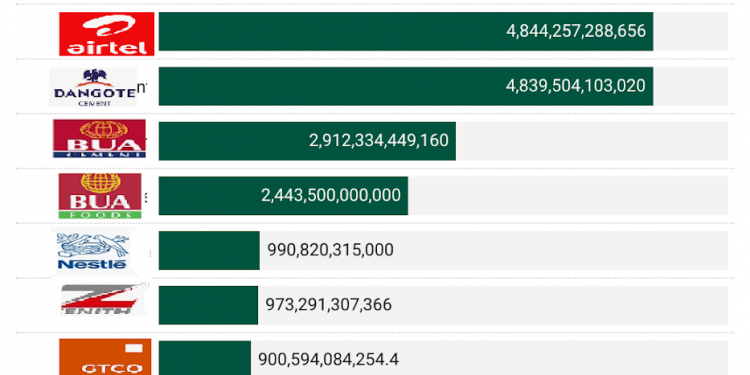

Listed telecom giants Airtel Africa, MTN Nigeria, and Dangote Cement topped the NGX capitalization charts in 2023. Airtel Africa dominated at N7.09 trillion, followed by MTN Nigeria (N5.54 trillion) and Dangote Cement (N5.45 trillion).

BUA Foods and BUA Cement followed closely at N3.48 trillion and N3.28 trillion, respectively. Seplat Energy reached N1.36 trillion while banking stalwarts Zenith Bank and GT HoldCo hit N1.21 trillion and N1.19 trillion.

The NGX market closed 2023 at a high, surging by 45.90 percent. CardinalStone Research analysts termed it the “post-inauguration rally.” Q4 2023 saw a significant 12.60 percent uptick, backed by positive earnings releases, followed by a strong Q2 with an 11.1 percent gain, attributed to the exchange rate unification and subsidy removal announcement.

All sectors closed positively, with Oil & Gas (+125.54 percent) leading, bolstered by SEPLAT (+110 percent). Banking, Consumer Goods, Insurance, and Industrial Goods sectors followed suit. The market saw 119 gainers and 12 losers, with some tickers like TRANSCOHOT (+1022.8 percent) leading gains, while others like ROYALEX (-39.42 percent) were among the top losers.

Market analysts anticipate continued positive momentum, urging strategic investment in sectors showing growth potential. Bargain-hunting and profit-taking activities are expected as investors position ahead of full-year earnings releases. Lagos-based Vetiva Research analysts foresee a sustained positive trend in the new year, highlighting the equity market’s impressive 45.90 percent YtD return in 2023.