Nigeria’s foremost PR Measurement and Evaluation agency, P+ Measurement Services, has released the Media Intelligence Report for the Banking and Insurance Sector for Quarter 2, 2020.

The report, based on the research data for advert and editorial analysis had an error margin of 5% at 95% confidence level and in Q1 and Q2 2020, a total of 3,360 publications were monitored.

A Senior Media Analyst at P+ Measurement Services said: “the need to show the impact of messages by the banking and insurance industry was the driving force behind this audit report and we will continue to lead the path in delivering media data-driven analysis in key sectors of the economy”.

He further stated that the sampled data and platforms used were 21 commercial banks in Nigeria and leading insurance companies’ media data; 44 newspapers including magazines; online media publications consisting of blogs, forums, financial sites, insurance sites, online news-sites and brand sites.

From the report, ThisDay Newspaper was the most sought after publication for banks, as BusinessDay Newspaper was the most sought after publication for insurance companies in terms of placement of adverts in the media.

In the banking industry, Q2 2020 had the following financial institutions topping the chart for print media advert spend: Access Bank (N147m), Zenith Bank (N144m), Fidelity Bank (N92m), First Bank of Nigeria (N85m) and United Bank for Africa, UBA (N74m). Furthermore, Q1 2020 had Access Bank (N163m), Zenith Bank (N161m), Fidelity Bank (N93m), United Bank for Africa, UBA (N91m) and First Bank of Nigeria (N81m) topping the chart amongst 21 commercial banks.

Conversely in the insurance industry, Leadway Assurance topped with the highest advert spend of N11m and N8m in Q1 and Q2 2020 respectively as AXA Mansard Insurance (Q1 – N6m, Q2 – N289,400) and Consolidated Hallmark Insurance (Q1 – N4m, Q2 – N2m) ranked closely, followed by Wapic Insurance (N3m) and Custodian Investment (N2m) which deployed advert only in Q2 2020.

Advert placement was sourced out more by the banking industry, with ThisDay Newspaper amassing N354,345,000 in Q2 2020 and N399,825,000 in Q1 2020. In the insurance industry, BusinessDay Newspaper amassed N4,754,000 in Q2 2020 and N10,845,700 in Q1 2020. Taking second place in the banking industry is BusinessDay Newspaper with N60,425,096 and N101,675,413 in Q2 and Q1 respectively and in the insurance industry, Daily Trust Newspaper made advert placements worth N2,606,859 and N810,600 in Q2 and Q1 respectively.

Third place was attained by Leadership Newspaper and The Punch Newspaper for banking and insurance industry respectively each with N54,565,357 in Q2, N70,600,511 in Q1 and N2,583,752 in Q2 and N3,609,757 respectively.

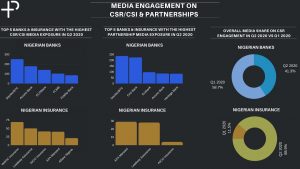

Findings from the report shows that the media engagement on Corporate Social Responsibility was led by Stanbic IBTC, Access Bank, Ecobank, First City Monument Bank and Fidelity Bank and the insurance companies that ranked most in the said engagement include WAPIC Insurance, Leadway Assurance, AIICO Insurance, AXA Mansard Insurance and Allianz Nigeria. The report also analyses the Partnership media engagement as Stanbic IBTC, First Bank of Nigeria, Ecobank, Access Bank and Heritage Bank led the banking industry while AXA Mansard Insurance, Leadway Assurance and AIICO Insurance led the insurance industry.

The media intelligence report shows the prominence of Chief Executive Officers of banks and insurance companies as Adesola Adeduntan of First Bank of Nigeria, Herbert Wigwe of Access Bank and Ebenezer Onyeagwu of Zenith Bank led the Bank CEOs and Babatunde Fajemirokun of AIICO Insurance, Tunde Hassan-Odukale of Leadway Assurance and Adeyinka Adekoya of WAPIC Insurance led the insurance CEOs in Q2 2020.

An analysis showed that Collins Nweze of The Nation was the most prolific reporter for the banking industry while Nike Popoola of The Punch topped the chart for insurance.

Click here to download the full report.